1. Shift to value and essentials

Consumer sentiment varies greatly across countries impacted by COVID-19. Consumers in China, India, and Indonesia consistently report higher optimism than the rest of the world, while those in Europe and Japan remain less optimistic about their countries’ economic conditions after COVID-19. Except for Italy, optimism has declined throughout European countries, in line with the rise in confirmed cases since late July.

Exhibit 1

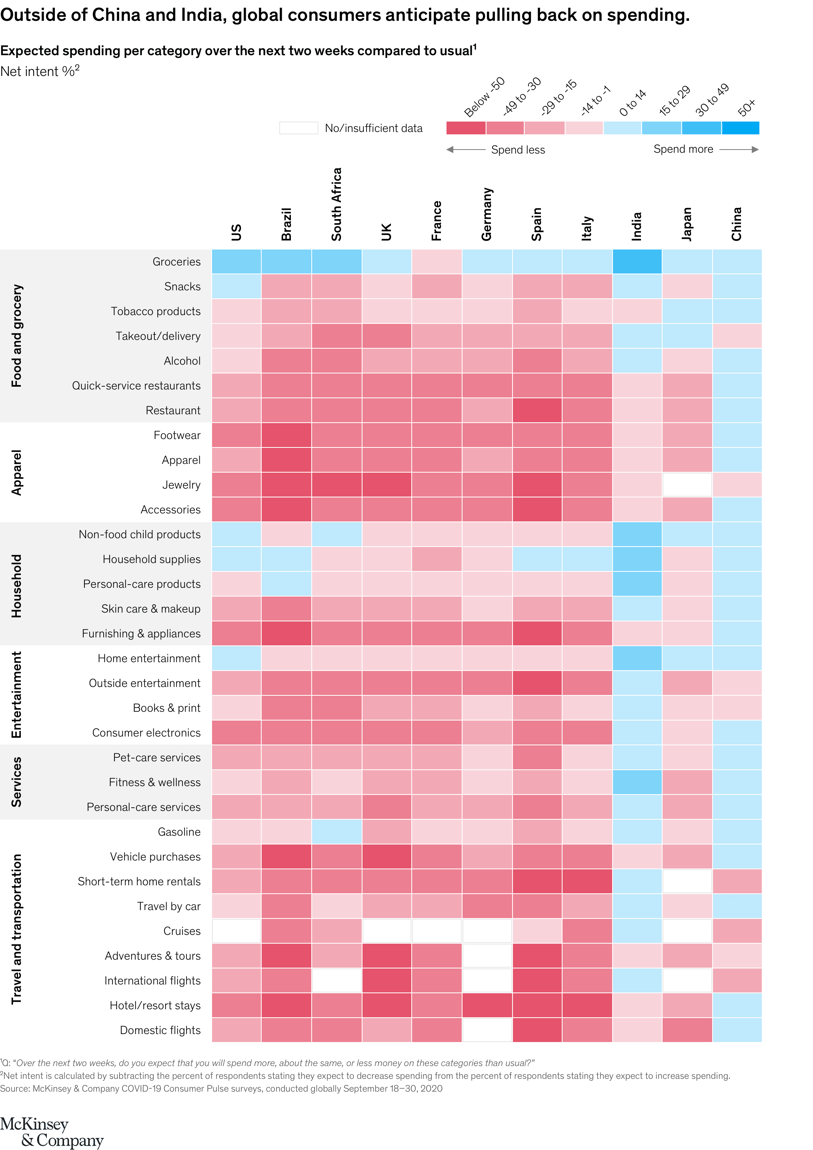

Divergent sentiment is also reflected in spending intent across categories. In most countries, consumers intend to continue shifting their spending to essentials, while cutting back on most discretionary categories. However, in China and India, spending is bouncing back beyond grocery and household supplies. Chinese consumers plan to increase spending on discretionary categories such as travel and apparel, suggesting that the country is further along the path to recovery than other countries. In India, consumers report a higher intent to spend across categories as they prepare for upcoming festivals (Diwali, for example) and the wedding season, which runs from October to December.

Exhibit 2

2. Shock to loyalty

Consumers across the globe have responded to the crisis and its associated disruption to normal consumer behaviors by trying different shopping behaviors and expressing a high intent (65 percent or more) to incorporate these behaviors going forward. However, the change has been less pronounced in countries with a moderate degree of economic shock, such as Germany and Japan.

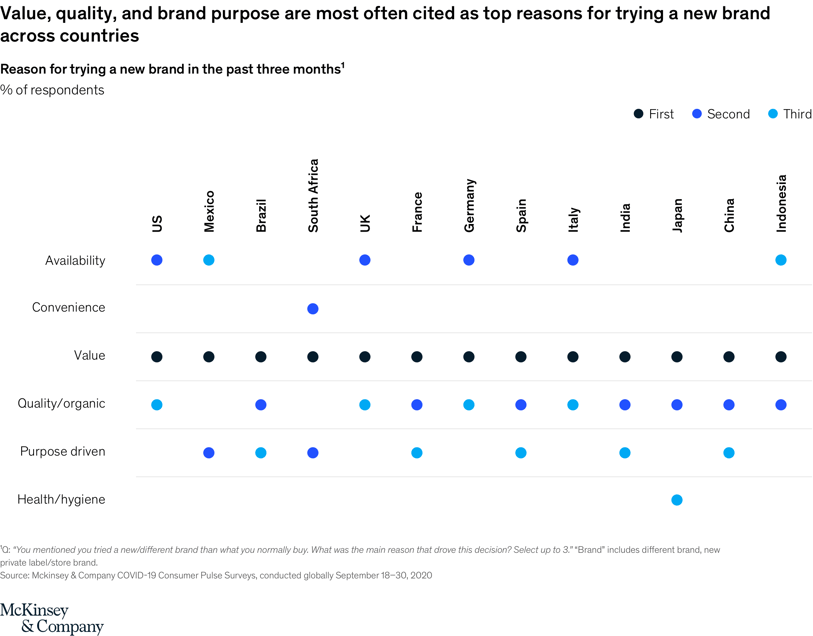

Exhibit 3

Exhibit 4

3. Homebody economy

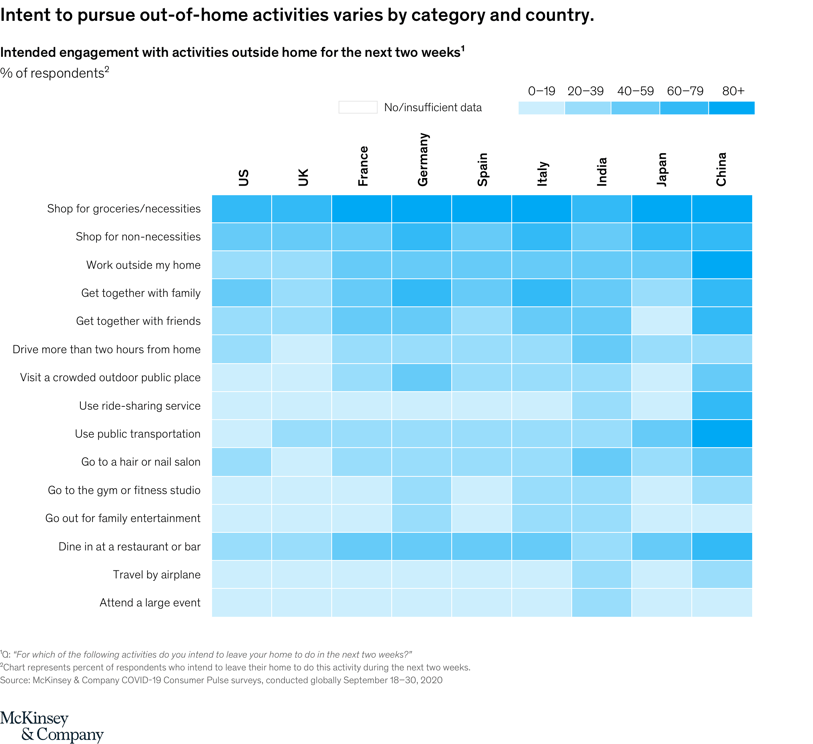

Consumers around the globe are at vastly different stages of resuming out-of-home activities. In China, more than 80 percent of consumers report engaging regularly with out-of-home activities. Countries with stricter government lockdown measures, such as Mexico and Brazil, have the lowest percentage of consumers reporting they have resumed “normal” activities.

Exhibit 5

Exhibit 6

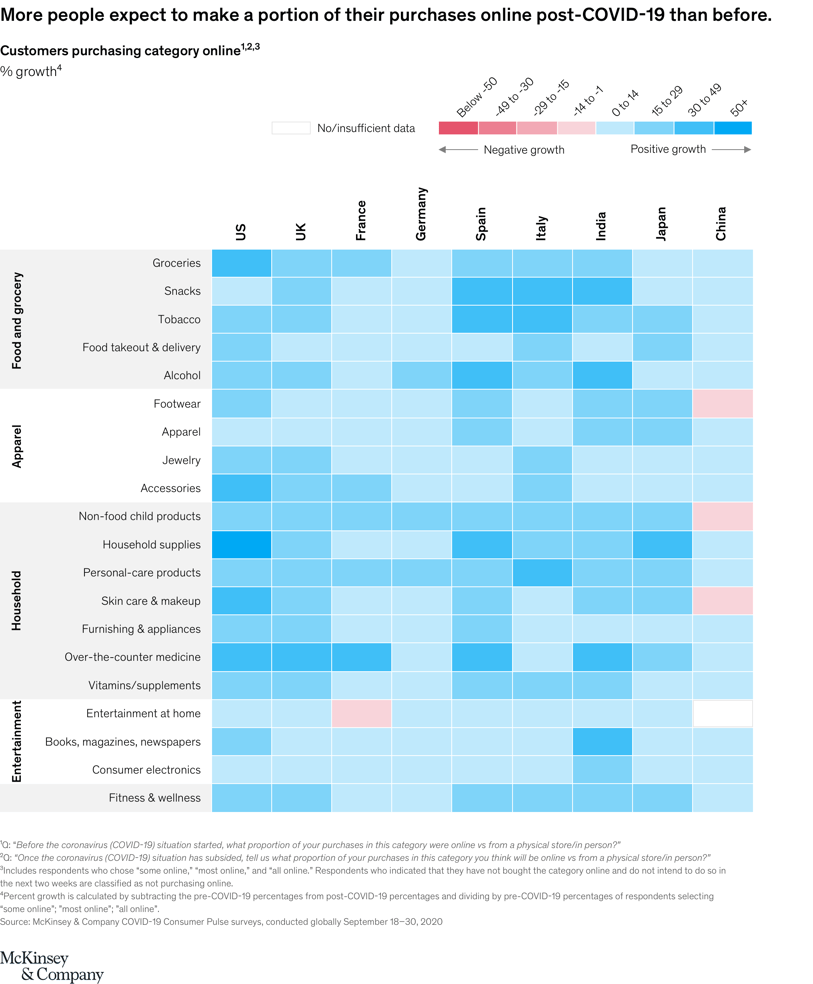

4. Flight to digital

The shift to digital persists across countries and categories as consumers in most parts of the world keep low out-of-home engagement. Food and household categories have seen an average of over 30 percent growth in online customer base across countries. Online growth for China seems more moderate, as the country had a high level of online penetration prior to the pandemic.

Exhibit 7

5. Holiday outlook

Compared to last year, consumers across the globe plan to reduce holiday spending, even in countries that have exhibited signs of recovery in spending intent in the next few weeks. China stands out as the only exception, with more consumers reporting increased spending than decreased spending.

The flight to digital and omnichannel will be prevalent during the holiday season, with 30 to 60 percent of consumers across countries reporting an intent to shift online for holiday shopping.

Exhibit 9

Or click directly to see survey results from these countries: Argentina, Australia, Belgium, Brazil, Canada, Central America, Chile, China, Colombia, Denmark, Dominican Republic, France, Germany, India, Indonesia, Italy, Japan, Korea, Mexico, the Netherlands, New Zealand, Nigeria, Peru, Poland, Portugal, Qatar, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, the United Arab Emirates, the United Kingdom, or the United States.

This article first appeared in www.mckinsey.com