Travel bargain hunters are a fickle bunch, visiting more than two dozen websites on average before they book. Booking.com and its rivals spend billions annually to woo those travelers who wouldn’t otherwise click over to their platforms.

Online travel is a weird industry when it comes to its outsized marketing spend as compared with other types of businesses.

None of this is shocking because it’s been the pattern for many years, but a BTIG investor report published Thursday put Booking Holdings’ marketing spend in a different context.

Booking Holdings, which owns brands including Booking.com, Kayak and Priceline, spent around $6 billion on marketing in 2022 — and that was about 35% of its total revenue. BTIG stated that Booking gets around 50% of its traffic direct; around 20 percent from free search engine listings; roughly 15% from social media, email, display ads and referrals, and 15% from paid search engine marketing — “and it spends billions annually to get that last piece.”

That’s worth repeating: Booking Holdings spent around $6 billion on sales and marketing last year to attract just 15% of visitors to its platform. (Sure, it directs some of that spend toward goals other than luring travelers to its platforms, but you get the general idea.)

How Expedia and Airbnb Do It

Over at rival Expedia Group, its marketing spend was even more top-heavy — around 47% of revenue last year.

Airbnb is an outlier in the online travel agency space because around 90% of its customers come directly to its website or app, as well as from free listings in search engines. You’ve heard the company’s talking points ad infinitum: Airbnb is so mainstream that it’s “a noun and a verb.”

So Airbnb focuses on limiting its paid search engine marketing on platforms like Google and Bing. Airbnb shelled out a very modest 18% of revenue on marketing in 2022.

Yes, before the hate mail arrives, it’s true that the three companies calculate marketing spend differently, but the basic points about their marketing spend as a portion of overall revenue hold true.

Airbnb Smart, Booking Foolhardy?

All of this is a contrast to most U.S. industries, according to a 2022 Gartner survey, which found them planning to spend a relatively minuscule 6-10% on marketing as a percent of revenue last year.

But before you leap to the conclusion that Booking’s strategy (35% of revenue on marketing) is dumb, and Airbnb’s approach (just 18%) is valedictorian-worthy, consider that Booking’s profit margin was considerably higher than Airbnb’s or Expedia’s last year.

Booking’s 2022 EBITDA margin was 31.3% compared with 23.2% for Airbnb, and 11.9% for Expedia. (True, their businesses are different as they sell some different things, and they are spread out across different geographies.)

Booking “has historically had an advantage in paid channels with a higher conversion rate, allowing it to bid more efficiently,” the BTIG report stated.

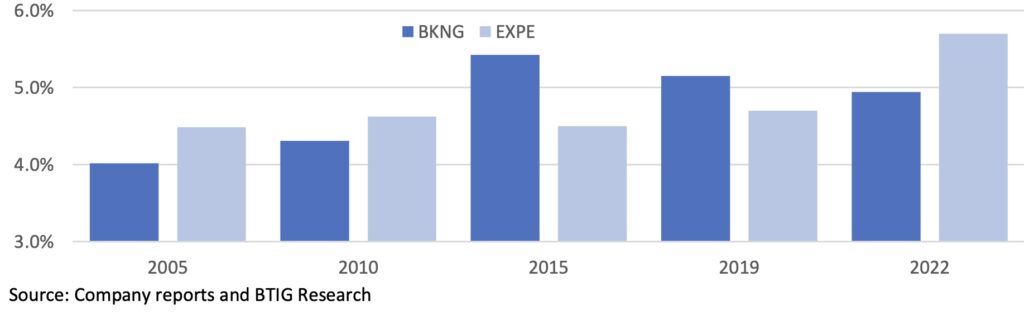

Another way to look at Booking’s advantage over Expedia is in marketing spend as a percent of bookings, not revenue, and by this metric Booking was more efficient, 4.9% versus 5.7%, according to BTIG.

Marketing as a Percent of Bookings, Booking Versus Expedia

Regarding these companies’ big-stakes marketing programs, now you know how strategic it is for them to try to attract more free, direct traffic to their websites and to coax more app downloads. It’s all in the hope that their customers won’t stray once they land on their websites, and won’t have to be enticed with billions of marketing dollars all over again.

___

This article first appeared in skift.com

Seeking to build and grow your brand using the force of consumer insight, strategic foresight, creative disruption and technology prowess? Talk to us at +971 50 6254340 or engage@groupisd.com or visit www.groupisd.com/story