Emotional loyalty, not transactional loyalty, should be the goal of a loyalty program, and Epsilon’s Eugene Yap says brands can achieve that by thinking holistically about the entire loyalty experience instead of just focusing on tactical program mechanics.

The beginnings of a modern loyalty program can be traced back to the late nineteenth century, when Green Stamps were distributed as part of a rewards program operated by Sperry & Hutchinson (S&H). The concept of the program was simple – S&H sold stamps to supermarkets, department stores and gasoline stations in the US. Customers collected stamps when they bought from these retailers and redeemed a set of stamps for products from a catalog or a local Green Stamps store.

Fast forward a century and not as much has changed in the loyalty space. Some of the largest loyalty programs in the world – Delta SkyMiles, Marriott Bonvoy and Starbucks Rewards – still follow a similar model. Instead of physical stamps, consumers collect digital points with every transaction that are used to redeem a variety of rewards.

Rethinking the value exchange

At the heart of a loyalty program is the concept of “value exchange”. Loyalty is valuable to brands. Loyal members of a program can spend up to three times more than non-loyal members over their lifetimes. To earn that loyalty, brands offer incentives in exchange – discounts, rebates and other redeemable rewards. The concept is simple – the more you spend, the more you get.

On the surface, this form of value exchange seems intuitive enough; after all, brands have been applying this playbook for the past hundred years. This transactional perspective of loyalty is further reinforced in the many consumer surveys that ask consumers what they want from a loyalty program – naturally, more points, more rebates and more rewards. However, do financial incentives truly drive long-term customer loyalty? This is the question Epsilon set out to address in developing the Epsilon Loyalty Index.

The Epsilon Loyalty Index adopts a different approach to understanding what drives loyalty. Instead of asking consumers what they want, we measured their actual loyalty behaviours – spend, tenure and share of wallet with a brand, and looked at their satisfaction with a wide variety of potential loyalty drivers. These drivers include fundamentals like price, place (distribution), promotions, product, service, as well as loyalty accelerators like financial incentives, recognition, personalisation and value-added services.

We then developed a proprietary model to understand which drivers have the biggest impact on actual behavioural loyalty. This study was conducted with more than 4,000 consumers across four categories – fashion apparel, beauty retail, grocery and consumer banking – in Australia and the UAE. The results were beyond our expectations. Our model was able to predict between 92% and 99% of any variation in loyalty behaviours across all the categories in both markets.

Financial incentives not the top driver of long-term loyalty

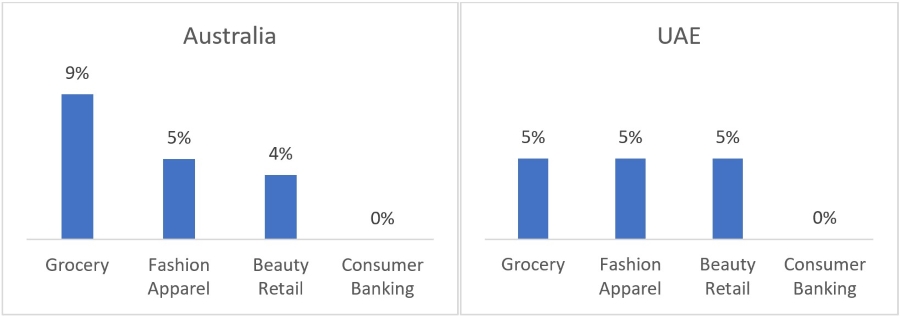

What was less surprising was that financial incentives, in the form of loyalty points, discounts and free products, did not appear in any category across both markets as the top predictor of loyalty. It was the second most important loyalty accelerator only in the grocery category in Australia, perhaps a reflection of how accustomed Australian consumers were to points-focused grocery loyalty programs like the Coles Flybuys Rewards Program and Woolworths Rewards Program in the market.

This is not to suggest that traditional financial incentives like loyalty points are not important; they still account for between 5% and 9% of any variation in loyalty attitudes (and hence loyalty behaviours) towards any brand in the study. However, this suggests that many loyalty marketers might be missing the forest for the trees when they focus on financial rewards as the primary value exchange mechanic with their customers.

Contribution of financial incentives to Epsilon Loyalty Index (ELI) score by categories

Loyalty drivers differ across markets and categories

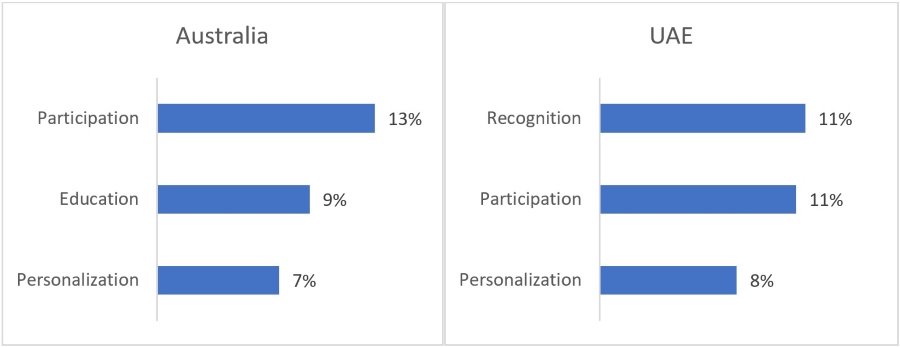

So, what other drivers predict loyalty among consumers? Interestingly, in the UAE, recognition appeared as the top loyalty accelerator across all categories. This can be attributed to the strong power distance inherent in the UAE culture, which accords greater respect and value to those of higher status. In this situation, offering more rewards without differentiating the experience for your VIP customers may not yield the desired loyalty outcome.

In Australia, building a special sense of community and listening to customer feedback turned out to have a bigger impact on loyalty than recognition and incentives across the categories. Education also emerged as an important loyalty driver across most categories, ranking either second or third as a loyalty accelerator, except for the groceries and apparel categories in UAE. Of course, there were differences across categories as well. For example, personalisation was much more important in the consumer banking category compared to the other three categories in Australia.

Top three loyalty accelerators and their contribution to the ELI Score across categories

From transactional to emotional loyalty

Our research with consumers in Australia and the UAE suggests that transactional value exchanges, in the form of points and tiers, may not be sufficient to build long-term behavioural loyalty. At Epsilon, we advocate a balanced approach to loyalty – targeting a customer’s share of heart, mind and value to maximise the brand’s impact on customer behaviour.

Emotional loyalty rather than transactional loyalty should be the eventual goal of your loyalty program. To achieve that, brands need to think holistically about the entire loyalty experience, rather than just focusing on tactical program mechanics. Brands can grow deeper emotional connection with their customers by using the REP framework – Recognise, Enhance and Personalise.

- Recognise: For customers to be genuinely connected to a brand, they must feel that they are more than just another name in the system. While offering higher-tier customers accelerated earn rates or incentives is the norm in loyalty programs, it does not necessarily make customers feel more special or appreciated. Chipotle Rewards program was revamped in 2019 with an aim to make their best customers feel recognised. On top of the earn-and-burn rewards, the program included a “surprise and delight” element as Chipotle understands that their members appreciate the special treatment. Top members have been surprised with invitations to events like music festivals and VIP tastings of new menu items. In addition, members receive insider information ahead of others.

- Enhance: Rather than just offering high-value customers more transactional incentives, brands should consider introducing value-added services that improve the overall customer experience. Lululemon’s Essential membership program offers value-added services to support members in their fitness journey. Membership benefits include receipt-free and fast-track returns, easier in-store exchanges on sale items, free hemming to ensure their apparel fits perfectly and access to fitness classes at home or on the go. These value-added services perfectly complement the busy lifestyles of Lululemon’s best customers and further differentiate the brand from its competitors.

- Personalise: Lastly, communications and offers to customers should be personalised based on their history with the brand and stated preferences. Brands can leverage zero-party and first-party data to identify products and offers that best appeal to each customer. This demonstrates that the brand understands their customers’ unique needs and interests. The Sephora Beauty Insider program offers personalised experiences and communications across all its channels. When customers visit a Sephora store to get their makeup done, the beautician can enter the products they used into their personal profile. Sephora’s app also allows customers to virtually try on products and receive recommendations based on their personal beauty traits. Member profiles are visible to sales associates, which allows customers to receive tailored recommendations based on their data like purchases, online browsing and in-store interactions. In 2022, for the fifth time in a row, Sephora claimed the top slot in Sailthru’s Retail Personalisation Index.

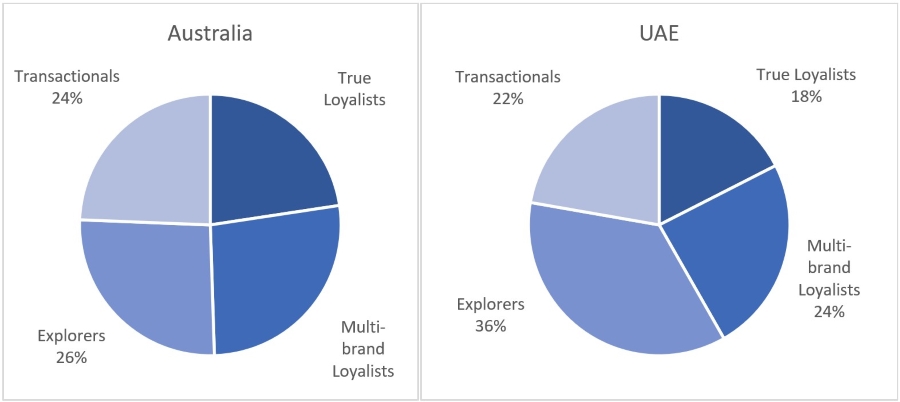

Finally, while it is important for loyalty programs to start looking beyond financial incentives to build loyalty, marketers should also be mindful that not all consumers are the same. In our study, we found that some consumers are “transactionals” who will always pursue the best offers and discounts, while others are “true loyalists” who desire connection and recognition from the brand.

Proportion of loyalty segments across categories

Eventually, the key to developing a world-class loyalty program lies in a deep understanding of who your customers are, the value they are seeking from your brand and the value (and loyalty) they offer in return. This is possible only when brands bring together the right strategy, data and technology to power their loyalty programs.

—

This article first appeared on www.warc.com

Seeking to build and grow your brand using the force of consumer insight, strategic foresight, creative disruption and technology prowess? Talk to us at +971 50 6254340 or engage@groupisd.com or visit www.groupisd.com/story