Post-mortems on start-up failures always intrigue me. Since coming to Silicon Valley in 1982, I’ve seen a good number of paradigm shifts and roadkill left on the side of the digital highway. Many characterized by founding team or VC avarice, arrogance, aberrance, deceit, inflexibility, capriciousness, and customer insensitivity.

Often there is a herd instinct when it comes to funding, driving droves of investors blindly over the start-up cliff. All too often, entrepreneurs are backed based on pedigree or past success, rather than clarity as to the problem, need, pain point, business model, or measurable market opportunity to be addressed. Disproportionate early-stage funding is allocated to engineering and product development, less to validating and certifying customer certainty and resonance. Hence the incidence of new venture re-directs, GTM delays and reincarnations.

One of my favorite daily reads are the updates and commentary from CB Insights. This month the research firm published a list of 378 start-up failure post-mortems. Here was an introductory note:

“In the spirit of failure, we dug into the data on startup death and found that 70% of upstart tech companies fail — usually around 20 months after first raising financing (with around $1.3M in total funding closed). So why do so many startups flame out? The real reasons can be hard to uncover, but the obituaries written by founders, investors, and journalists offer plenty of clues.”

CB Insights dug deep and came up with 210 of the biggest, costliest start-up failures of all time. Topping the list was Katerra with $1.5 billion in disclosed funding (from Softbank and other notables), along with Quibi which swallowed $1.75 billion and lasted just six months after launching its streaming service.

CB Insights dug deep and came up with 210 of the biggest, costliest start-up failures of all time. Topping the list was Katerra with $1.5 billion in disclosed funding (from Softbank and other notables), along with Quibi which swallowed $1.75 billion and lasted just six months after launching its streaming service.

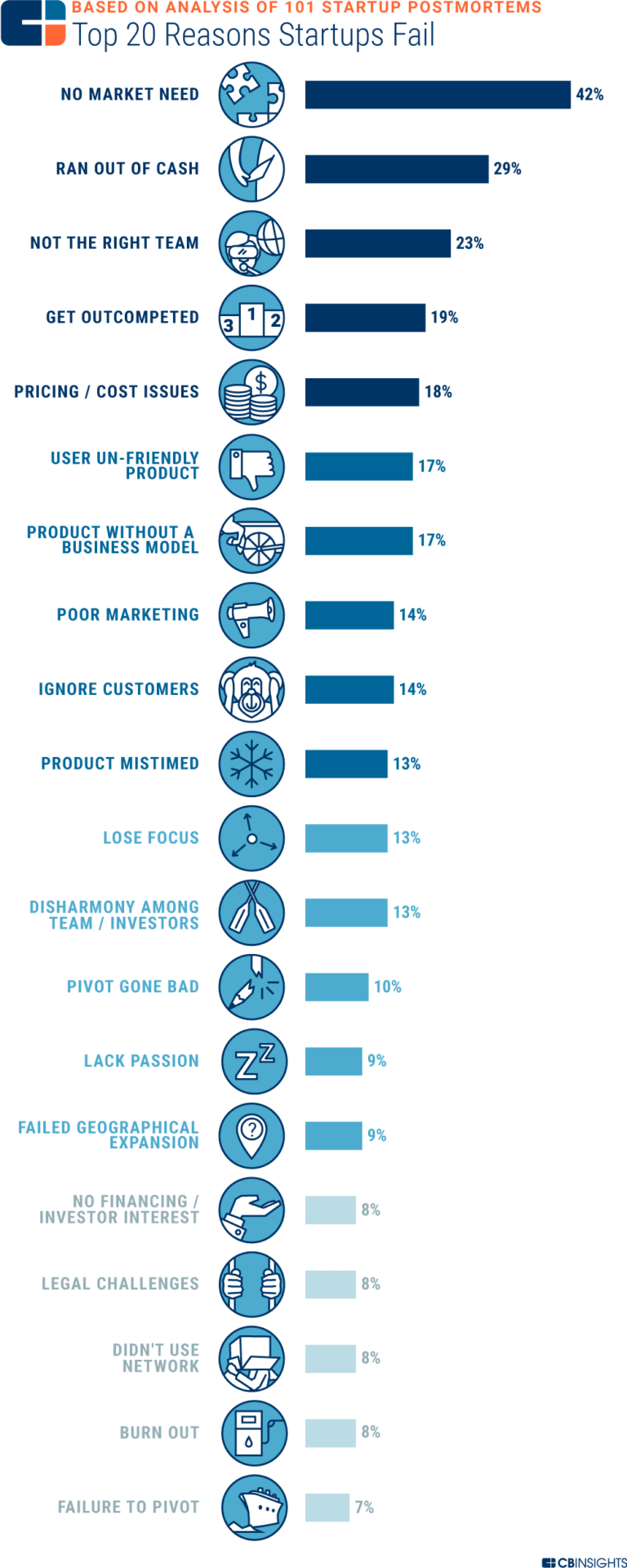

Seems hard to believe. These are raging bushfires, not bonfires, of cash. The research buffs at CB Insights did their analysis and came up with a ranking of the top 20 reasons for start-up failure based on a scrub of the obstacles and issues encountered by 101 dearly departed ventures.

Unbelievably, the top reason for failure by 42 percent of the companies was cited as “no market need,” well ahead of “ran out of cash” (29%) and “not the right team” (23%). Inquiring CMO minds will be pleased to know that many of the causes ending the life of new ventures have their origins in strategic marketing planning and effective execution. Here’s another eight I pulled from the list of 20:

- Get outcompeted (19%)

- Pricing/cost issues (18%)

- User un-friendly product (17%)

- Product without a business model (17%)

- Poor marketing (14%)

- Ignore customers (14%)

- Product miss-timed (13%)

- Failed geographical expansion (9%)

Given this analysis, why is the investment community not relying more on seasoned, professional marketers to evaluate, shape, and influence critical business and investment decisions in early-stage companies.

Here is one post mortem quote from a listed CB Insights failure that attests to this:

“Startups fail when they are not solving a market problem. We were not solving a large enough problem that we could universally serve with a scalable solution. We had great technology, great data on shopping behavior, great reputation as a thought leader, great expertise, great advisors, etc., but what we didn’t have was technology or business model that solved a pain point in a scalable way.” Treehouse Logic

CMO Council research finds less than four percent of professional marketers serve on the boards of publicly traded companies and do not seem to have the same respect as the technical masterminds and engineering perfectionists populating early-stage ventures.

U.S. venture capital funds raised over $69 billion in 2020 despite pandemic headwinds. VC deal-making in the U.S. was resilient with nearly 11,000 ventures and $150 billion in funds invested (Pitchbook). Perhaps more of that money should have been applied to analyzing the commercial market opportunity and the relevance of products in the pipeline before all the cash was consumed. As we say in the headline: “Define the need before you bleed!”

…

This article first appeared in www.cmocouncil.org

Seeking to build and grow your brand using the force of consumer insight, strategic foresight, creative disruption and technology prowess? Talk to us at +971 50 6254340 or mail: engage@groupisd.com or visit www.groupisd.com/story