Even marketers at tech companies don’t have an edge when it comes to content management technology.

Slightly more than one in four (28%) say they have the right tech to manage content across the organization. But most haven’t acquired the right tech (29%) or have the tech but aren’t using its potential (32%). (And 11% aren’t sure about it all.)

That’s one of the findings in CMI’s newly released Technology Content Marketing Benchmarks, Budgets, and Trends: Insights for 2023. Sponsored by Foundry, an IDG, Inc. company, the survey encompasses responses from 278 tech marketers in our July 2022 content marketing questionnaire.

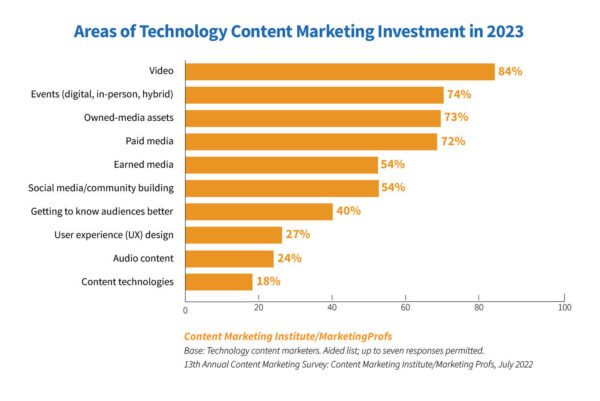

Where tech marketers plan to invest

Tech marketers’ use of tech mirrors B2B marketers as a whole in their planned investments for this year. Video tops the most popular investment, with 84% of technology marketers expecting their organization would invest in it this year. Other most frequently cited investments include:

- Events 74%

- Owned media assets 73%

- Paid media 72%

- Earned media 54%

- Social media/community building 54%

Fewer than half expected investment in getting to know audiences better (40%), UX design (27%), audio content (24%), and content technologies (18%).

Building community is more important than ever

While video remains the most popular, investment in social media/community-building saw a big jump with 54% picking the category – over 46% more than the previous year. Consider those plans with a significant interest in events (74%), and it looks like tech marketers are prioritizing relationship-building in 2023.

“When you focus on building a community, you’re creating a space where your audience feels heard, valued, and understood,” says Lorenzo Mitil, CMI’s social media manager. “That kind of environment encourages engagement and inspires people to come back for more.”

Demandbase embraces that philosophy. About a year ago, it launched a community called Revenue Circle for people who have vice-president-level roles (or higher) in sales and marketing. The community hosts exclusive virtual and in-person events (alongside other company events). Demandbase Social and Influencer Marketing Director Justin Levy says the big draw in private communities like Revenue Circle is networking opportunities with other members, especially as layoffs increase. “The community becomes its own universe, with its own goals attached that are separate from – but complementary to – those of our organization,” Justin says.

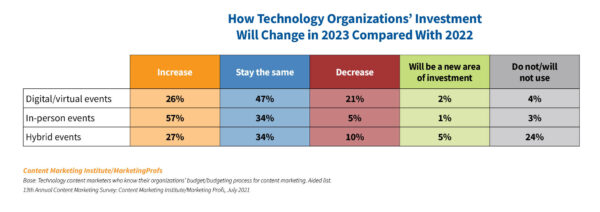

Plans for hybrid events evolve

While events as a content marketing tool are popular, the specifics for tech marketers are interesting. Not surprisingly, over half (57%) expect their organization to increase spending on in-person events compared with the previous year. Given the interest in digital and hybrid events during the prime pandemic years, it’s remarkable that tech marketers still plan to invest more in digital/virtual events (26%) and hybrid events (27%). Interestingly, nearly as many (24%) say they won’t use hybrid events in 2023 (only 3% won’t use in-person events, and 4% won’t use digital or virtual events).

“The pandemic proved that the serendipity found in the unexpected moments at an in-person event isn’t replicable elsewhere,” says Nicole Peck, vice president and general manager of North American events at Foundry. “When done correctly, event participation allows a brand to connect with its customers in an authentic way, providing much-needed, emotionally forged relationships.”

What does 2023 hold?

Community-building by and for tech marketers couldn’t come at a better time.

News of such widespread layoffs in the tech industry may have prospects and customers wondering about everything from service levels to product roadmaps to the basic survival of your brand. (According to Layoffs.fyi, tech companies laid off nearly 161,000 employees worldwide in 2022 and nearly another 120,350 between Jan. 1 and March 1, 2023.)

In February, we asked CMI audience members who work for tech companies how they’re faring. Of the 155 who responded, only 12% said they had been laid off. Almost half (49%) worked for companies that laid off employees but not them, and 39% said their company hadn’t laid off anyone.

For those tech marketers who witnessed layoffs, about half said their workloads increased (sometimes without an increase in pay), and one-third said they haven’t been affected much or at all because the staff reductions happened elsewhere in the company. Of the group that saw layoffs, 10% percent said their teams have pivoted, changed processes, etc., and a handful have been moved to different teams, such as product marketing.

How secure do those employed feel about their future with the company? Most felt unlikely they would get laid off in the next year.

Although the sample size for the group who were laid off was small, nearly all had secured another full-time job or freelance work. A few emphasized how difficult it was, though, given the current competitive climate for job seekers. (If you’ve been laid off, consider these tips to help you find your next opportunity.)

Navigating the tech marketer landscape

These results offer only a glimpse of what tech marketers told us. To learn more about content creation, content marketing practices, and more, read the full report. You’ll also find out what top-performing tech marketers do differently, which can perhaps inform your strategy for the rest of 2023.

ENDS

—

This article first appeared https://contentmarketinginstitute.com

Seeking to build and grow your brand using the force of consumer insight, strategic foresight, creative disruption and technology prowess? Talk to us at +971 50 6254340 or engage@groupisd.com or visit www.groupisd.com/story

![Surprising and Expected Results From Tech Content Marketers [New Research]](https://www.brandknewmag.com/wp-content/uploads/2023/04/shrine-s320191119-32387-v9srsa20191119-32387-1l3fx1l20191119-32387-jy59l9-1.jpg)